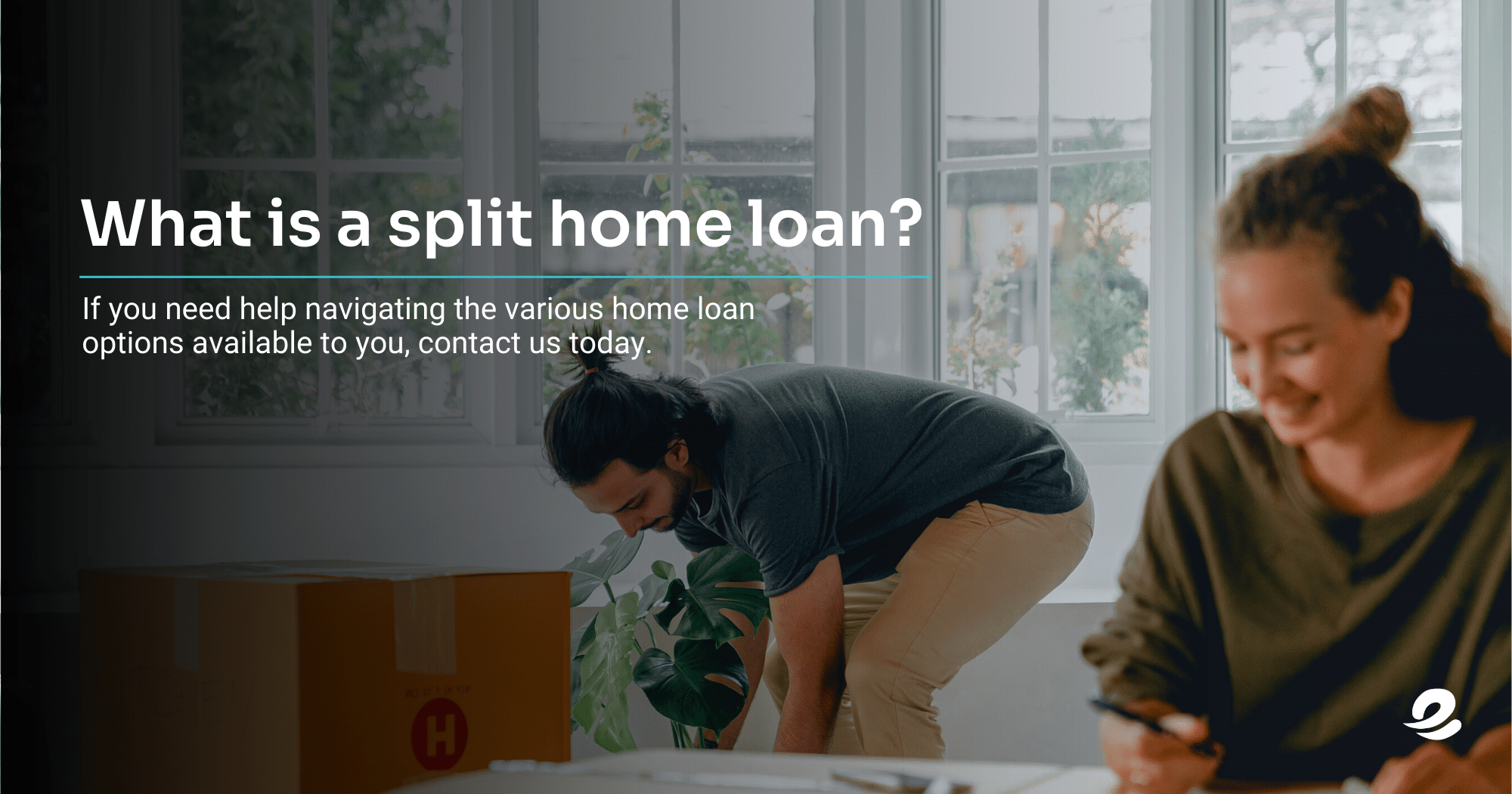

What is a split home loan?

As the name suggests, a split rate home loan is one that allows you to split your mortgage into multiple loan accounts that attract different interest rates. They are a comfortable compromise that allows you to enjoy the benefits of both variable and fixed rate mortgages at the same time.

There are no restrictions on how you portion your split loan—you can split your home loan down the middle 50/50, or you can split it 30% variable and 70% fixed. Let’s say, for example, you require a loan amount of $350,000, you can decide to split your loan with $250,000 at a variable interest rate and the remaining $100,000 at a fixed interest rate. You will have the flexibility a variable rate loan offers, while still enjoying the certainty of a fixed rate on a portion of the loan.

Benefits of a split loan

- Split loans give you some of the flexibility of a variable loan while still managing the risk of interest fluctuations. Depending on your lender, how you proportion the split is up to you. The fixed component allows you to lock your mortgage in at a specific rate for a set term. The variable portion of your split loan will be set to the variable interest rate set by your lender.

- You will be able to make extra repayments on the variable portion of the home loan, which could help you pay it off sooner.

- In choosing a variable and fixed portion split, your variable portion will likely have additional benefits such as an offset account or a redraw facility.

Things to consider

- You may miss out on potential savings on the fixed portion of your loan if interest rates should fall.

- You will pay more on the variable portion of your loan if interest rates rise.

- There may be additional costs associated with a split loan (especially if you choose to split your loan after your initial home loan settlement).

- If you need to pay out the loan early within the fixed term, early repayment costs will be charged.

Think about where you want to be in the next five years, this will help you choose a loan with features suitable to your goals and objectives. If you need help navigating the various home loan options available to you contact emoney today.

We recommend you seek independent financial advice prior to making any decisions that could affect your financial security.

First Home Buyer's Guide

Enter your email address for instant access to our handy First Home Buyer's ebook.

Construction Loan Guide

Building a new home. Find out about the construction loan process.